Happy Friday, and welcome back to the Life is Rich Roundup!

AllianceBernstein Joins the Retirement Income Party

Hot off the press: AllianceBernstein just announced they’re adding the AB Secure Income Portfolio as an option for defined contribution plans.

The new strategy offers lifetime income during retirement and will be available as a Collective Investment Trust (CIT). CITs are pooled retirement investment vehicles only available to qualified retirement plans like 401(k) plans and government plans.

“Providing plans with a new way to access lifetime income through a DC-friendly CIT will give plan sponsors the convenience and optionality they’re looking for.”

- Jennifer DeLong, head of defined contribution at AllianceBernstein

This comes shortly after BlackRock’s “Paycheck for Life” announcement. Read our thoughts on that here.

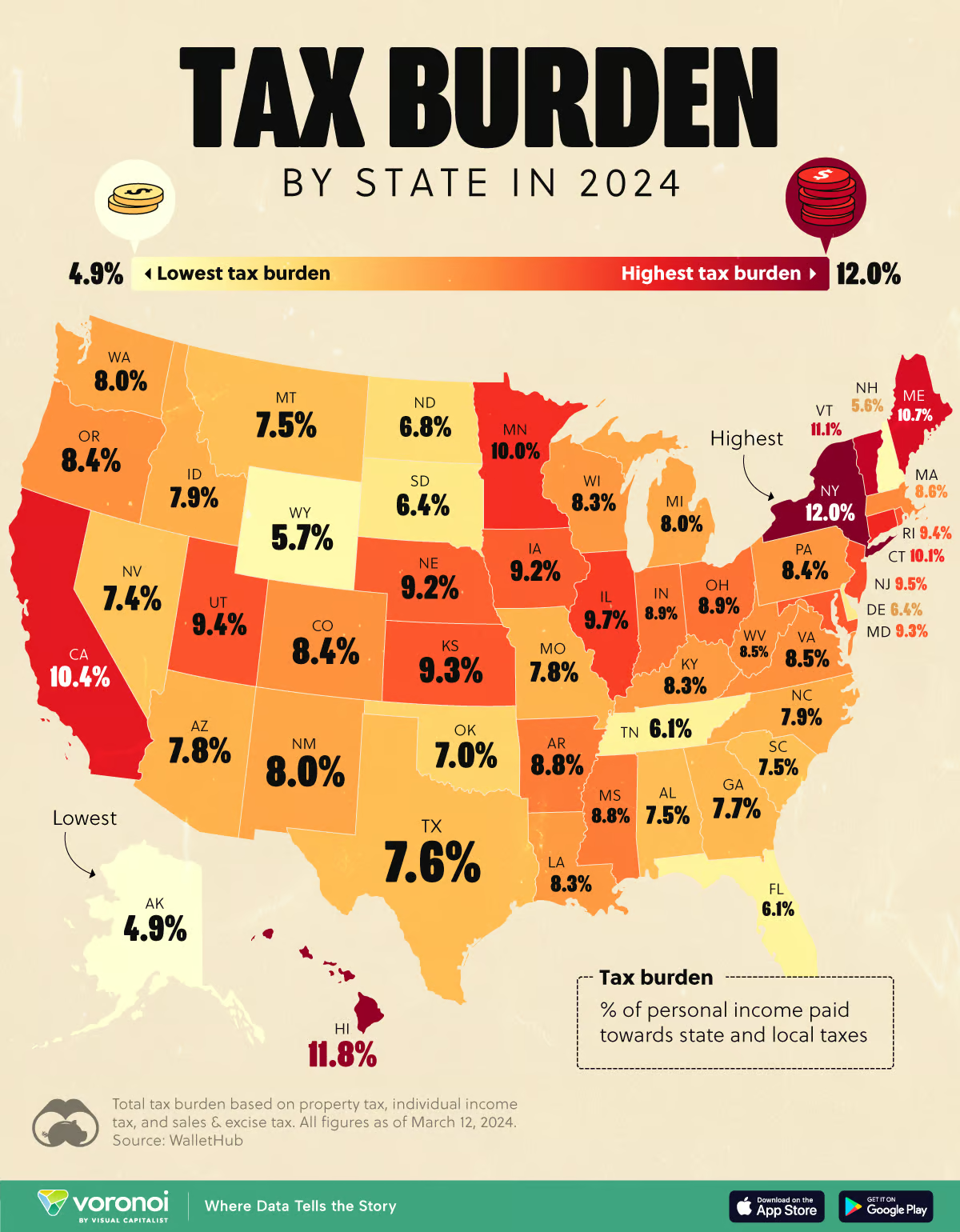

State Tax Showdown

Cool visual of the total tax burden in each U.S. state as of March 2024. New York residents have the highest total tax burden, paying 12% of their income to state and local governments. On the other end of the spectrum, Alaska has the lowest: 4.9%.

Check out the full breakdown here.

How to Make Retirement Less Scary

The New York Times

Check out this fun and interactive little adventure about writing your retirement mission statement. It’s the exercise of writing down your key principles to help guide you toward your goals.

Check it out. Here’s our favorite part:

Retirement will probably be easier if we have people to share it with. Researchers have found that close relationships, more than money, are what keep people happiest after 65.

Maybe the most important thing we can do now is invest in relationships, even as we try to earn and save what we can.

- Ron Lieber, The New York Times

Will Millennials Be Able To Retire?

In a recent study from Northwestern Mutual, the average retirement savings balance among millennials is $62,600. That's a respectable sum for younger millennials in their late 20s. But the “elder” millennials closer to 40 are in trouble.

There’s no doubt millennials have had it tough, so it’s not surprising they are behind on retirement. But instead of listing all the hardships they’ve faced, we’ll just share this funny meme.

We’re Living Longer and the Gender Longevity Gap is Closing

The headline kind of says it all. Spain’s Universidad de Alcalá recently released a report that found longevity in humans is increasing and the gap between male and female life expectancy is narrowing.

Now if only there was a new way to help hedge against longevity so people would have enough money in retirement. Oh, wait….

The Good & Bad News of the Week

|

|

Savvly Blog on College Grad Money Tips

Our amazing CU Boulder interns made it through finals and officially started at Savvly this week. In honor of them, our latest blog post focuses on how recent graduates can navigate the transition from campus to career with smart financial moves.

Links You Might’ve Missed

60 Facts Most People Don’t Know

Roller coasters were invented in the 1880s to distract Americans from sin.

See the others here.

Got a story recommendation or idea to share for our next article? Hit us up at marketing@savvly.com.

Over and out,

Team Savvly

Recent posts

Related Posts

How to Create Your Own Pension

Taking Care of the "Future You"