#NoRegrets? 401(k) Inventor Disturbed by His Own Creation

Welcome back to the Life is Rich Roundup.

Let’s take a look at some of the latest and greatest things going on in the world of retirement lately.

The Father of the 401(k) is Disturbed by His Own Creation

In 1978, Ted Benna reinterpreted a tax law and created the 401(k) to give his employees additional retirement benefits. Soon after, 401(k)s were rolled out everywhere, replacing the traditional pension. “The Father of the 401(k)” sat down with Fortune to talk about the state of retirement.

“It was never designed to be what it is today. I became very disturbed by what happened with investment expenses. With the original 401(k) plan, employers were supposed to pay the administrative fees, record keeping audits, etc., rather than the participants.”

- Ted Benna, “Father of the 401(k)”

He says he didn’t intend to kill pensions — they were on the decline one way or another. He goes on to acknowledge the good 401(k)s have done for Americans, and that many employees wouldn’t have been able to retire without them.

But overall, Benna is concerned about the future of retirement. We share that concern, which is why we are building something better at Savvly.

Read the full interview here.

I Guess We’re All Really Important

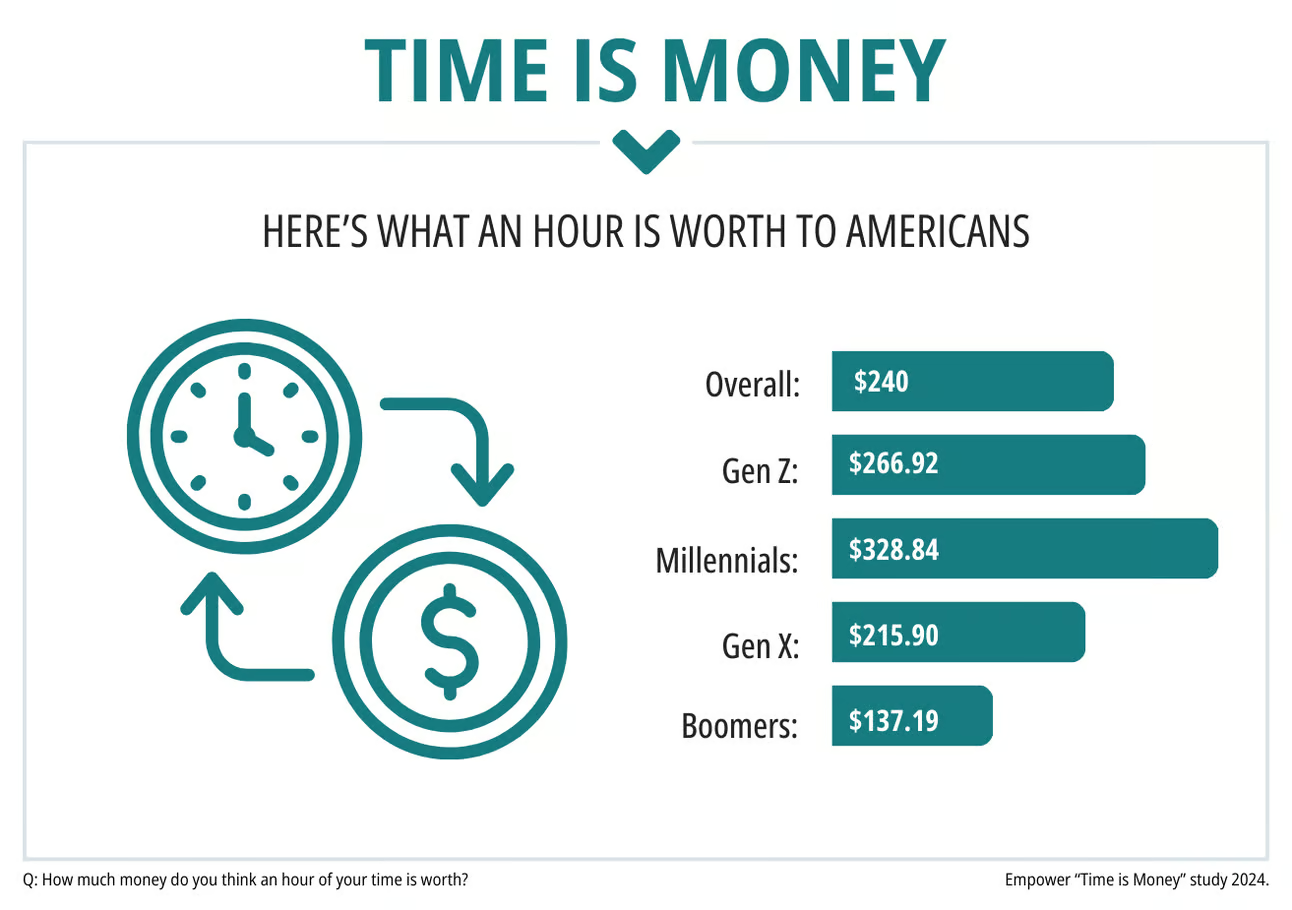

Time is money, so they say. In a brand new study from Empower, Americans say their time is worth $240 per hour, on average.

Based on a standard 40-hour week, that puts the perceived value at $499,200 per year — about 8 times higher than the average U.S. salary of $59,384. Check out the breakdown by age group.

We love to see millennials staying on brand. Additional findings from the study include:

-

63% of people “feel wealthy” if they have enough time to spend with family and friends.

-

37% say saving time is more important than saving money.

-

29% feel comfortable taking on debt if it buys more free time.

-

26% are willing to take a 15% pay cut to gain more free time.

-

26% would spend $5,000/year to have someone else manage their long-term financials, investments, and savings.

-

21% would use AI to recommend money moves to plan for retirement.

The 6 Best Jobs For Brain Longevity

If you have a hard job, there’s a silver lining. According to a new study of more than 7,000 Norwegians in 305 occupations, people with the least mentally demanding jobs had a 66% greater risk of mild cognitive impairment, and a 31% greater risk of dementia, after the age of 70, compared with those with the most mentally demanding roles.

Cutting to the chase: the 6 best jobs for brain longevity are Teacher, Doctor, Engineer, Scientist, Manager, and Lawyer.

We’ve Reached the Peak…

This year the U.S. hits “Peak 65” — when the number of Americans reaching age 65 is at its highest level. Peak 65 raises concerns for all generations.

Jason Fitchner, Retirement Income Institute’s Executive Director discussed the findings of their recent study:

“We’re talking about putting policies in place for the generations that are following, because we’re also in a peak millennial moment. The problems we’re seeing today with the retirement income challenges of current retirees and near-retirees will be magnified for those who are coming 30 years behind them. If we don’t do something today to help them, it’s going to be worse.”

- Jason Fitchner, Retirement Income Institute

We agree 100%.

The Good & Bad News of the Week

Savvly Blog: How to Retire Early

Retiring early while maintaining your financial independence can be achievable with a little strategy, discipline, and creativity.

Whether you're looking to retire a year ahead of schedule or you’re planning to jump into retirement decades early, our latest blog shares 8 ways to fast-track your retirement. Check it out here.

Links You Might’ve Missed

-

The Federal Reserve holds interest rates steady, offers no relief from high borrowing costs

-

A ‘longevity revolution’ is coming. Here’s how those over 100 are making the most of their lives

-

A Honduran tourist island has attracted a lot of people interested in longevity

-

Walmart Takes On Trader Joe’s and Whole Foods With New Premium Brand

-

With more of us living longer, traditional retirement plans just won’t cut it

-

Healthy vegetarian diets may boost longevity, slash heart disease death risk

Got a story recommendation or idea to share for our next article? Hit us up at marketing@savvly.com.

Over and out,

Team Savvly

Recent posts

Related Posts

High-Yield Savings 101: What, How, and Why

When Can I Retire?